The leaders of the Magyar Nemzeti Bank (MNB) painted a very slightly optimistic picture at the online presentation of their latest commercial real estate market report on Thursday. It was previously established that, except for the hotel sector, there was almost only bad news in all submarkets last year, generally few investments were started (except for warehouses), underutilization increased and investors continued to turn away from the sector. The banks have significantly tightened their project lending conditions, but there is still no need to worry, because their exposure in this direction is still low.

Optimism was based on the fact that inflation is expected to decrease further in 2024, that rising real wages and growing consumer confidence can support economic growth and, through this, the strengthening of commercial real estate market activity.

“The quality of the project loan portfolio is favorable, the credit institutions’ ability to withstand shocks is strong, and their capital provision is at an appropriate level, which the MNB will further strengthen with a preventive capital buffer requirement,” said head of department Sándor Winkler.

He pointed out that last year the performance indicators of the hotel sector improved – thanks to foreign guest traffic, and in the other segments individual investor and government decisions, as well as the return of economic growth this year, may bring some improvement.

“Export performance is restrained by the weak European economy, but at the same time, the implementation of ongoing and newly announced significant capacity-expanding foreign direct capital investments will help the expansion of exports in the long term, having a positive effect on industrial-logistics demand and developments.” he added.

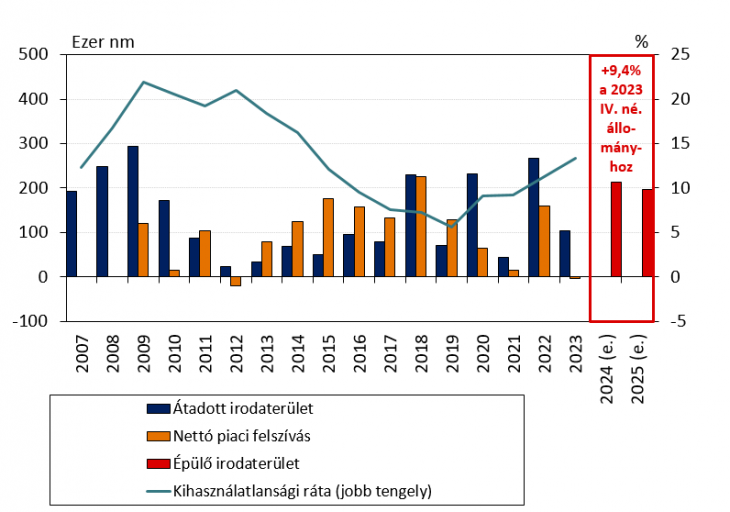

Taking the individual segments in order, he first talked about the office market. He said that developers have noticeably slowed down, seeing a significant drop in demand. At the same time, the proportion of pre-leases for new investments is 61 percent, which he called adequate. Although he did not say it, his prediction that the vacancy rate could rise to between 14.4 and 14.7 percent by the end of the year, which has been on the rise for more than a year and a half, may be a bit worrying.

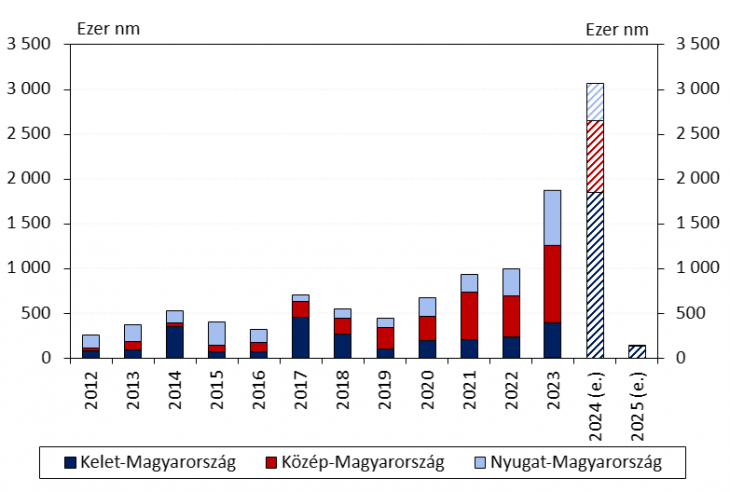

What is the situation in the industrial logistics market? Well, there the unutilized rate increased from 3.8 percent at the end of 2022 to 8.6 percent by the end of 2023, but stagnation is expected this year. Fortunately, pre-leasing is also high here, around 54 percent, but the investors will hand over hundreds of thousands more square meters of land around the capital. In the countryside, in addition to the larger industrial cities, logistics centers are being built for their own use, thus increasing the total stock by about 20 percent.

Last year’s drop in retail sales was felt by both the retail chains and the shopping centers. In the latter, especially in the county seats, the proportion of vacant land became dramatically higher. This indicator increased from 5.5 percent to 9 percent. No improvement is expected here in the coming months, at most towards the end of the year.

According to the MNB, the purchase of commercial real estate for investment purposes was extremely low. A total of only 600 million euros could be recorded, which is 38 percent less than the 2022 turnover. The last time it was this low was during the 2008-2009 crisis. 82 percent of this volume was linked to Hungarian investors, and the proportion of Hungarian investors has been increasing for years. According to the central bank, rising yields, high financing costs and moderate rental demand continue to encourage investors to wait, which predicts a low investment turnover for 2024 as well.

In all countries of the CEE region, the primary office yield (for properties with the best location and quality) increased, and investment turnover decreased by between 24 and 68 percent per country. The capital values calculated on the basis of primary office yields and rents decreased by an average of 8 percent in the CEE region and 9 percent in Budapest by the end of 2023 compared to a year earlier, and cumulatively over the past year and a half, a decrease in value of 13 and 21 percent can be seen, respectively.

Finally, they discussed how banks behave in this economic environment. It was found that in 2023, banks disbursed project loans secured by commercial real estate in a 42 percent smaller volume, and the volume of new issues decreased for all types of real estate except for hotels. Based on the MNB’s Lending Survey, in the fourth quarter of 2023, banks tightened lending conditions in all commercial real estate segments, and further tightening was expected in the first half of 2024 due to the changed risk tolerance.

Overall, the total balance sheet total and solvency capital of domestic credit institutions’ project loan exposure secured by commercial real estate is proportionally less than half of the level after the 2008 crisis, and there was no deterioration in portfolio quality either. Due to potentially rising commercial real estate market risks, in October 2023 the Financial Stability Board of the MNB decided to reactivate the systemic risk capital buffer (SyRB), which was suspended indefinitely at the outbreak of the coronavirus epidemic, from July 2024, for preventive purposes, strengthening the banks’ ability to withstand shocks.

Tags: year bad year MNB predicting revival commercial real estate market year

-